Retroactive Tax Credits 2024 California Time – Tax season always seems to start off with some kind of quirky, what-if component. This year, the what-if involves the possible expansion of the child tax credit, which likely would be . So, while a tax increase is true for most people making more than $154,000, the potential combined tax rate of 14.4% applies to California’s top income tax bracket, meaning people earning more than $1 .

Retroactive Tax Credits 2024 California Time

Source : www.shrm.org

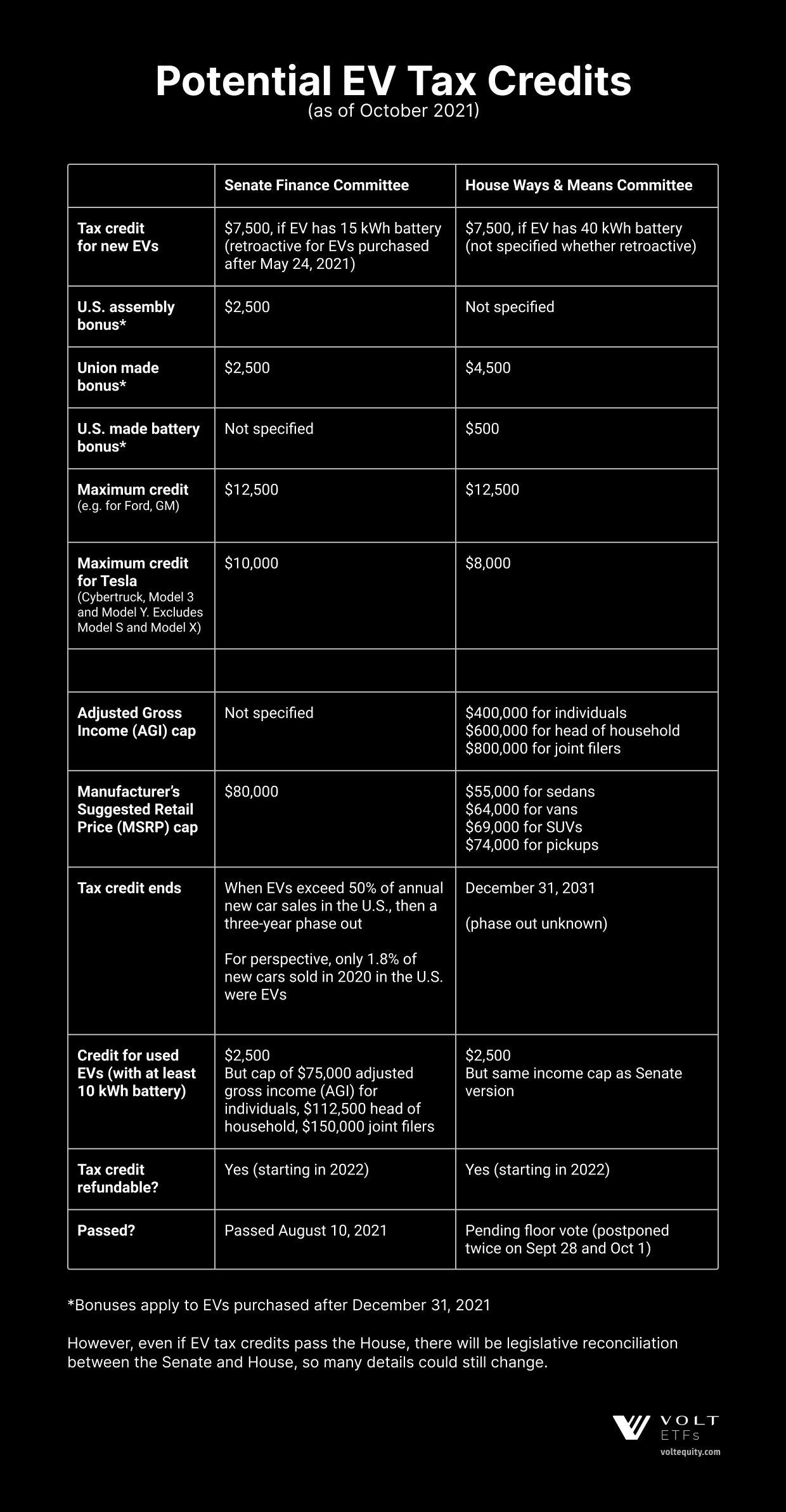

The Tesla EV Tax Credit

Source : www.voltequity.com

California Solar Incentives And Tax Credits (2024)

Source : www.architecturaldigest.com

FUTA Credit Reduction: Impact on California Businesses in 2024

Source : californiapayroll.com

Alameda County Social Services Agency

Source : www.facebook.com

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

Monterey County Community Action Partnership

Source : www.facebook.com

Amazon.com: PassKey Learning Systems EA Review Part 1 Individuals

Source : www.amazon.com

Many Inflation Reduction Act rebates won’t be ready until 2024

Source : www.latimes.com

Many Inflation Reduction Act Rebates Won’t Be Available Until 2024

Source : www.bloomberg.com

Retroactive Tax Credits 2024 California Time Retroactive Filing for Employee Retention Tax Credit Is Ongoing : Supporters of the bipartisan tax bill needed a statement vote out of the House Ways and Means Committee on Friday to help their cause — and they sure got one. . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .